China's Tariffs on US Agricultural Products Go Into Effect

On Monday, Beijing began putting tariffs on major agriculture products from the United States, China's main foreign market. It's the latest escalation in a trade war between the world's two biggest economies.

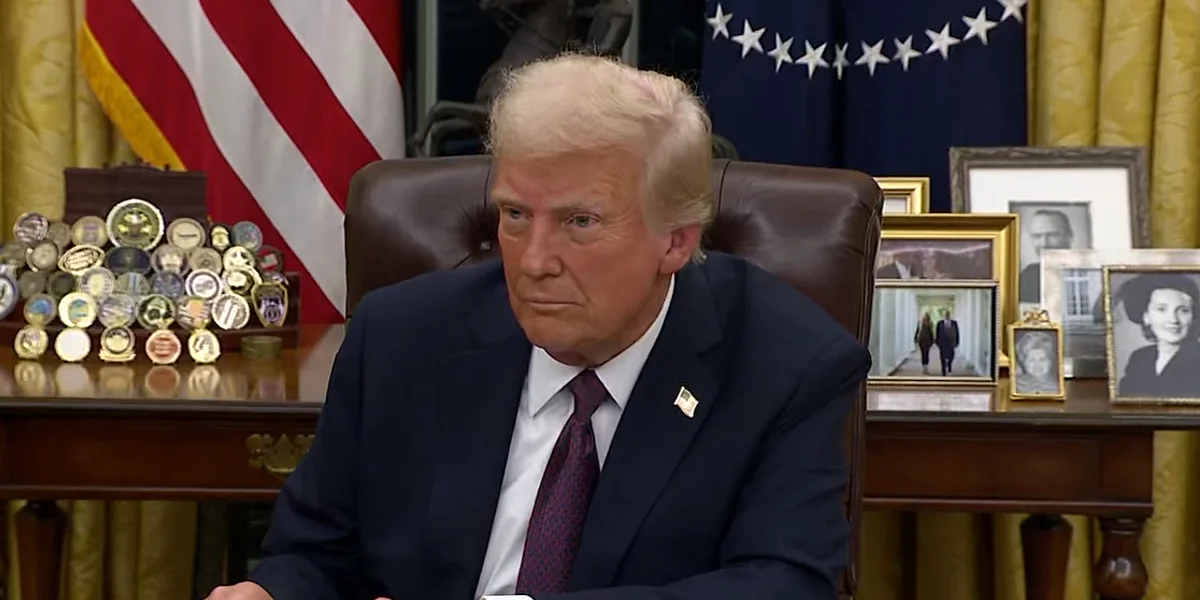

Beijing levied the levies in response to President Trump's 10% additional blanket tax on Chinese imports. As a result of China's retaliatory move, US farmers now face 15% levies on poultry, wheat, and maize, as well as 10% levies on soybeans, pig, cattle, and fruits.

The Chinese government also said that it will prohibit 15 US businesses from purchasing Chinese items unless it provided special authorization, including a drone company that serves the US military. It also stated that it was preventing ten additional US corporations from doing business in China.

Beijing stated that items exported before Monday and imported by April 12 will not be subject to the increased levies. Because goods such as soybeans, wheat, and corn are often transported by sea, China's customs officers will collect minimal duties until shipments reach in China after leaving the United States on Monday or later.

A spokeswoman for China's National People's Congress, which is now holding its annual legislative session, stated last week that Trump's new tariffs had "disrupted the security and stability of the global industrial and supply chains."

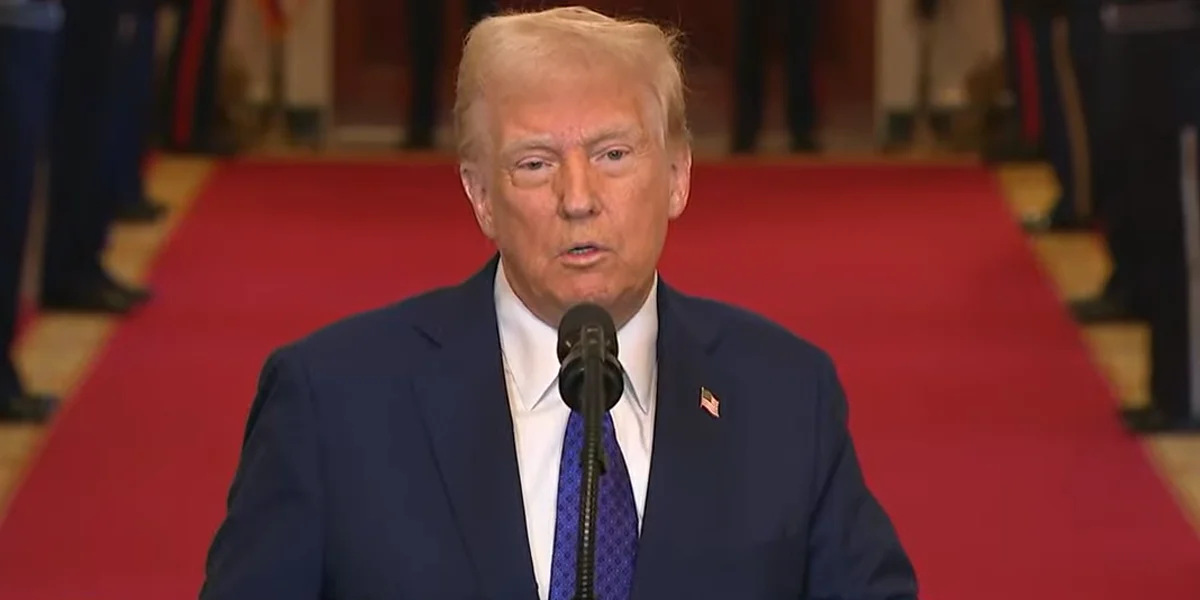

Mr. Trump has said that tariffs on Chinese imports, the majority of which are manufactured products, are necessary to help the United States to rebuild its manufacturing sector while also generating tax income for the federal budget. He put a 10% duty on practically all Chinese imports in early February, raising it to 20% last week. He stated that the moves were aimed to put pressure on China to stop the supply of the narcotic fentanyl into the United States.

China has replied in kind to Mr. Trump's trade steps many times in recent weeks, including Monday's sanctions. After the president slapped 10% tariffs in early February, China announced taxes on natural gas, coal, and agriculture equipment imported from the United States.

Nonetheless, China has other options for dealing with the protracted trade dispute. In the past, it has reduced taxes on Chinese firms who export goods to the United States, allowing them to lower prices and mitigate the consequences of a US tariff.

Chinese corporations have also relocated final assembly of their products to nations such as Vietnam and Mexico, with whom the United States has enjoyed relatively liberal trade ties in recent decades. But Trump has attempted to close this loophole by slapping tariffs on Mexico.