Dick's Sporting Goods is nearing a $2.3 billion deal for Foot Locker

Dick’s Sporting Goods Inc. is in advanced talks to buy Foot Locker Inc., whose stock had dropped 41 percent this year amid the back-and-forth over tariffs, according to people familiar with the matter.

Dick’s is considering paying $24 per share for Foot Locker, The Wall Street Journal reported Wednesday, citing people familiar with the matter. That is roughly a 90% premium to Foot Locker's Wednesday closing price of $12.87.

According to the persons, an agreement may be revealed as early as Thursday. They asked not to be identified since the conversations were confidential.

Foot Locker's stock ended at $12.87 on Wednesday, giving the business a market worth of $1.22 billion. The stock rose more than 60% in extended trading in New York after The Wall Street Journal revealed discussions for a $2.3 billion transaction.

While both chains rely significantly on selling footwear, combining them would result in two corporations with drastically distinct business structures. Foot Locker is a 2,400-store chain made up of mostly smaller locations in cities around the world, whereas Dick’s is comprised of roughly 800 big-box stores in suburbs across the US.

Under chief executive officer Mary Dillon, Foot Locker has been looking to boost sales by renovating a large portion of its store network while promoting its rewards program. The firm has tried to improve its relationship with Nike, which had previously distanced itself from wholesale partners in order to boost its own sales channels.

A final agreement hasn’t been reached and details including the timing could still change, the people said. Dick's and Foot Locker representatives did not immediately return calls for comment.

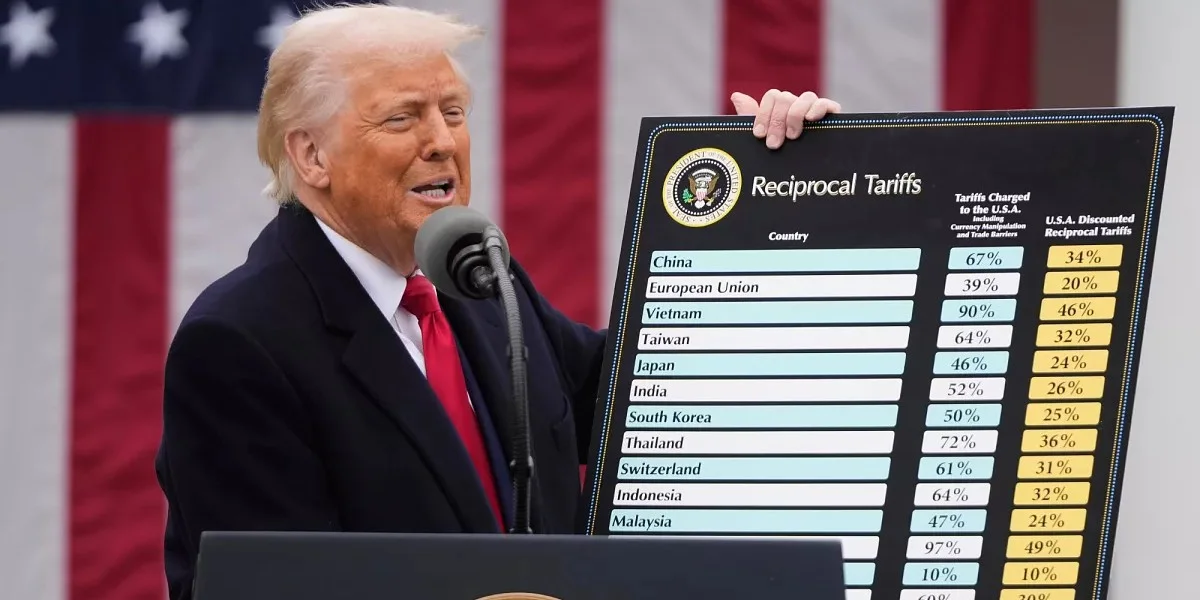

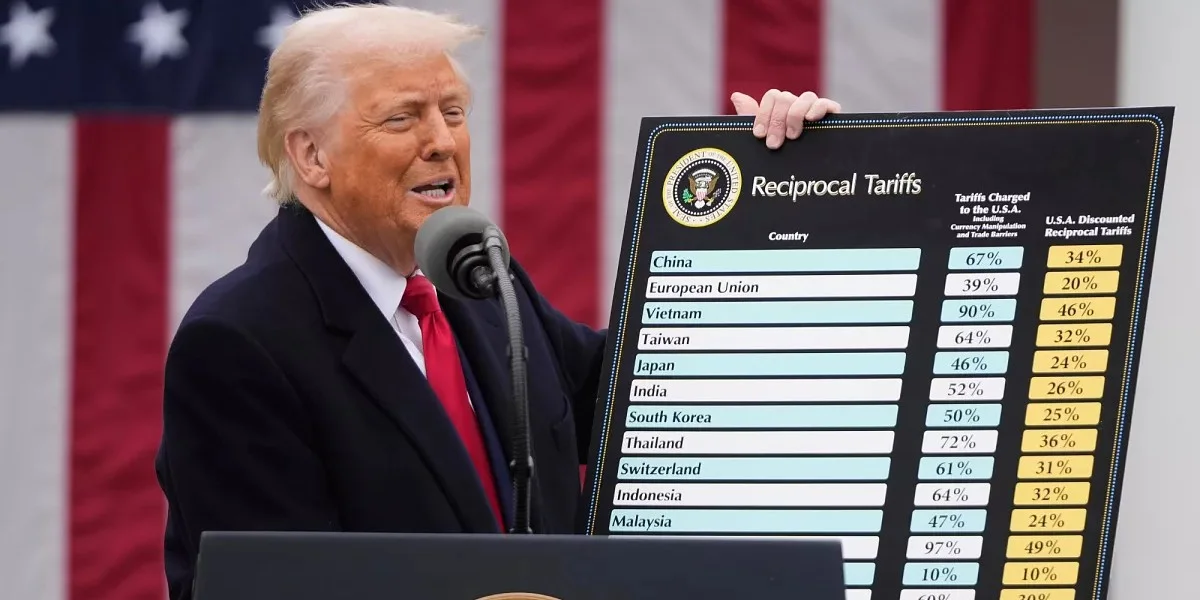

Foot Locker shares have been hammered particularly hard by anticipated tariffs on China and other Asian nations.

Acquiring Foot Locker, one of the largest sneaker retailers in the U.S., could help Dick’s consolidate market share in the footwear space and grow its store footprint, giving the company an edge to compete at a bigger scale, said Lorne Bycoff, co-founder & CEO of the Bycoff Group.